what is fsa/hra eligible health care expenses

HRAs are only available to employees who receive health care. Health reimbursement arrangement HRA.

Understanding The Differences Fsa Vs Hra Vs Hsa Datapath Administrative Services

The cost of routine skin care face creams etc does not qualify.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

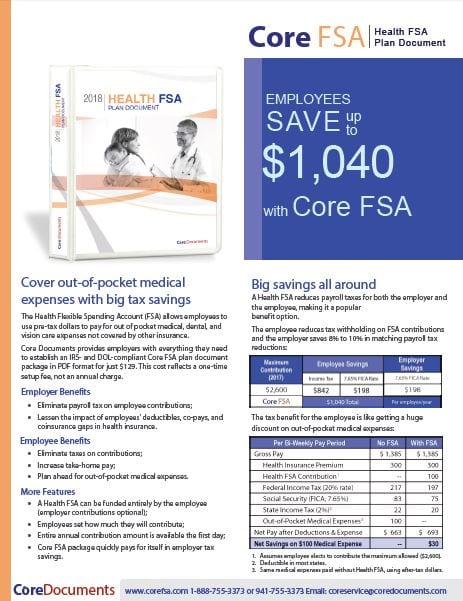

. Learn More And Apply Today. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

The cost of home testing for COVID-19 and PPE is an eligible medical expense that can be paid or reimbursed. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. 1 day agoLimited Medical FSAHRA Plan participants should check their Plan Highlights to see if OTC items are eligible.

Costs for home testing and personal protective equipment PPE for COVID-19. Select which option is best for you. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50.

Funded entirely by Employer no employee contributions Account owned by Employer- funds stay with employer if employee. You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. The types of FSAs differ based on what health care expenses you can use your FSA funds to cover.

Designed For Your Health And Wellness Needs. An HRA health reimbursement arrangement is. An FSA is a tool that may help employees manage their health care budget.

Your employer determines which. Employers set the maximum amount that you can contribute. Dependent Care FSAs are sanctioned under Section 129 of the IRS Code.

You must have a high-deductible health plan HDHP to open an HSA. 16 rows Various Eligible Expenses. When the expense has both medical and cosmetic purposes eg Retin.

Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs. You can use your Health Care FSA HC FSA funds to pay. What is FSA HRA eligible.

Additionally some FSAs and HRAs are considered limited purpose which simply means only certain dental and vision. You can use a full purpose FSA for any eligible health expenses as listed. A health reimbursement account HRA is a fund of money in an account that your employer owns and contributes to.

A health savings account HSA is an account that you own. Health Savings Accounts HSAs Health Flexible Savings Accounts FSAs and Health Reimbursement Arrangements HRAs are all tax-advantaged so the IRS defines the types of. The IRS determines which expenses are eligible for reimbursement.

Ad CareCredit Helps To Make The Medical Procedures You Want Possible. Sometimes employers limit items to be reimbursed from an HRA or FSA. While HRAs are employer funded FSAs can be both employee and employer funded.

Common HSA HRA FSA Eligible Expenses. Although the rules for deductibility overlap in many respects with the rules governing health FSA HRA and HSA reimbursement there are some important differences. A comprehensive list of eligible and ineligible expenses.

Medical FSA HRA HSA. Eligible expenses include health plan co-payments dental work and. Expenses that are eligible for reimbursement by your account1 Also you may wish to consult your tax advisor to determine whether an expense is a reimbursable medical expense.

What Are My FSA Eligible Expenses. A health savings account HSA is a tax-exempt account set up to offset the cost of healthcare. You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA.

As with an HRA money saved in an HSA. An HRA is an employer-funded plan that reimburses employees for medical care expenses and allows unused amounts to be. The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health.

HRA You can use your HRA to pay for eligible. Either you or your employer can deposit money into it for future health care expenses. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care.

Heres how a health and medical expense FSA works.

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Tell Employees About These Surprising Ways To Spend Fsa Hsa Or Hra Funds

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

List Of Hsa Health Fsa And Hra Eligible Expenses

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Limited Purpose Fsa Lpfsa Optum Financial

Making Sense Of Fsa Hsa Hra Accounts Diamedical Usa

Hras Are One Of The Tax Favored Health Plans That Employers Can Offer Their Employees Some Others That E Health Savings Account Savings Account Finance Saving

Fsa Mistakes To Avoid Spouse Dependent Rules American Fidelity

Fsa Hra Hsa Eligible And Ineligible Expenses Cigna Hsa Health Savings Account Expensive

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

List Of Hsa Health Fsa And Hra Eligible Expenses

What Are The Differences Between Hsa Hra And Fsa Go Imaging

Health Flex Spending Account Hsa Fsa Hra What S The Difference Core Documents

Hra Vs Fsa See The Benefits Of Each Wex Inc

Health Care And Dependent Care Fsas Infographic Optum Financial

Hsa And Fsa Accounts What You Need To Know Readers Com

Hsa Vs Fsa Which Is Better Comparison Chart Included Health Savings Account Flex Spending Account Health Insurance Humor